Audio Overview: Listen & Learn

In today’s construction industry, every single dollar really counts and can make a big difference.

Material costs are rising, labor is scarce, and unexpected expenses can destroy even the best-laid plans.

For small construction firms, creating a robust construction budget is the difference between project success and the budget getting out of hand.

This guide explains the construction budgeting tips to help keep your project costs in check and maintain the profitability of your construction business, regardless of the state of the economy.

Budgeting Tips Every Small Construction Business Should Know

Budgeting in construction is about making informed decisions with every dollar, not just cutting costs. Whether managing a small two-person crew or overseeing a larger team, your success hinges on effectively planning for labor costs, materials, and other associated costs that impact your bottom line.

Think budgeting sounds boring? Not here. We’re sharing practical tips that small construction business owners like you can begin implementing today. From understanding the role of cost estimators to learning how to improve your construction estimates, this guide breaks it down in plain language.

If you've ever wondered, “Where did all that money go?” you’re in the right place.

Key Takeaways

- Rising costs and unplanned delays make effective construction budgeting important for every small construction company.

- Cash flow management and contingency funds help minimize cost overruns.

- Real-time tracking and flexible budgeting help protect your construction company’s bottom line.

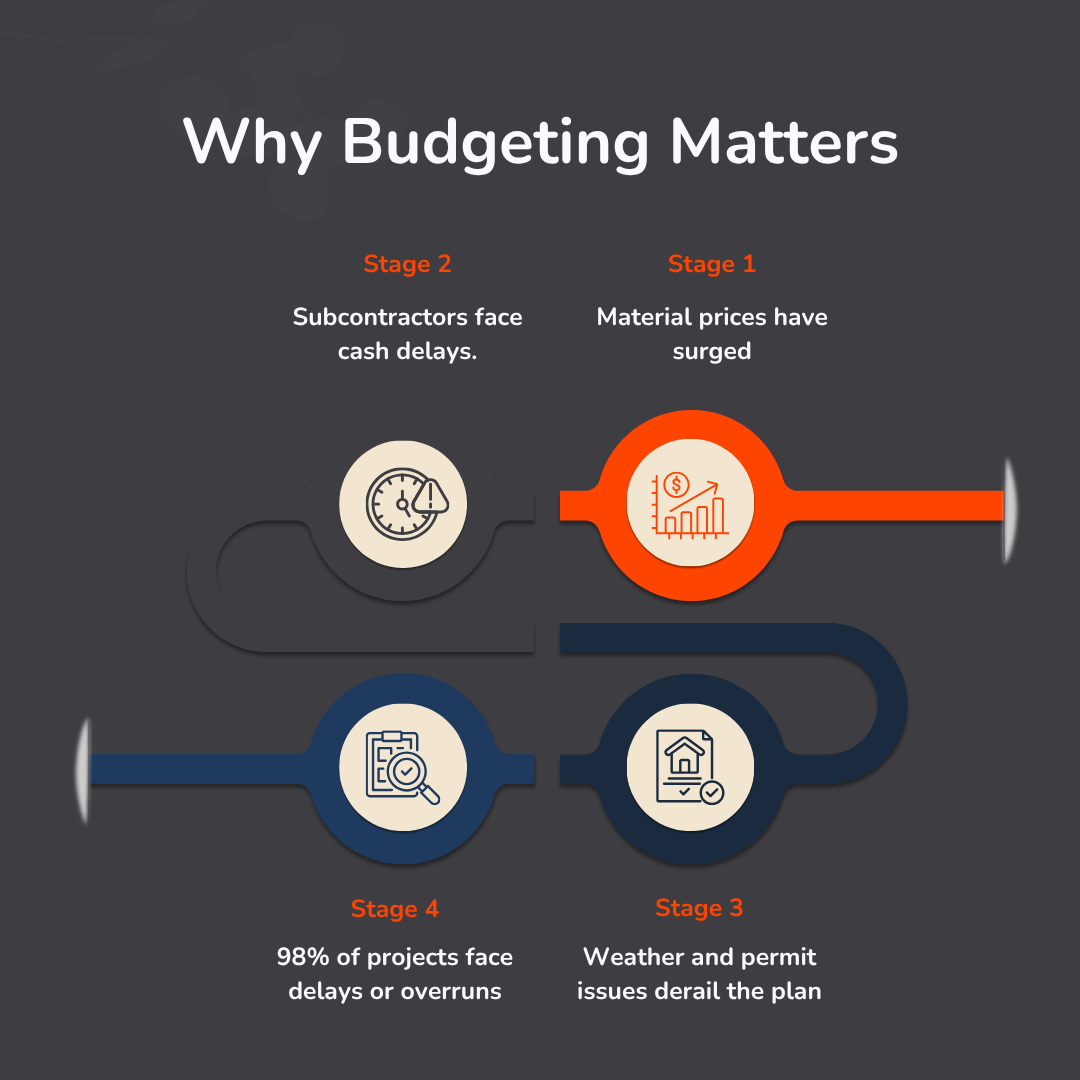

Why Budgeting Matters More Than Ever for Small Construction Firms

In a volatile market, disciplined construction budget management is more than a best practice. It’s survival.

1. Rising Material Costs & Inflation

Construction costs, especially for materials like steel and cement, have surged in the past two years. For small construction firms, this means a tight project budget can be wiped out by a single supplier price hike.

Including a contingency fund and regularly updating your construction budget template are critical to avoid cost overruns.

2. Cash-flow crunch for Subcontractors

Small businesses face a common challenge: delayed payments and retainage.

Progress payments that trickle in slowly can leave even the most experienced construction project manager struggling to pay direct and indirect costs on time.

To maintain a healthy construction project budget, it’s important to forecast cash flow, separate project expenses from company finances, and use cloud-based project management software to track actual expenses in real time.

3. Unplanned Delays & Cost Overruns

Weather delays, permit costs, and supply chain disruptions are facts of the construction process. But when your construction budget is already razor-thin, these unexpected expenses can destroy project profitability.

A McKinsey study found that nearly 98% of construction projects face cost overruns or delays.

Solution? Adding a risk management plan and building flexibility into the project plan helps construction project managers navigate the unexpected.

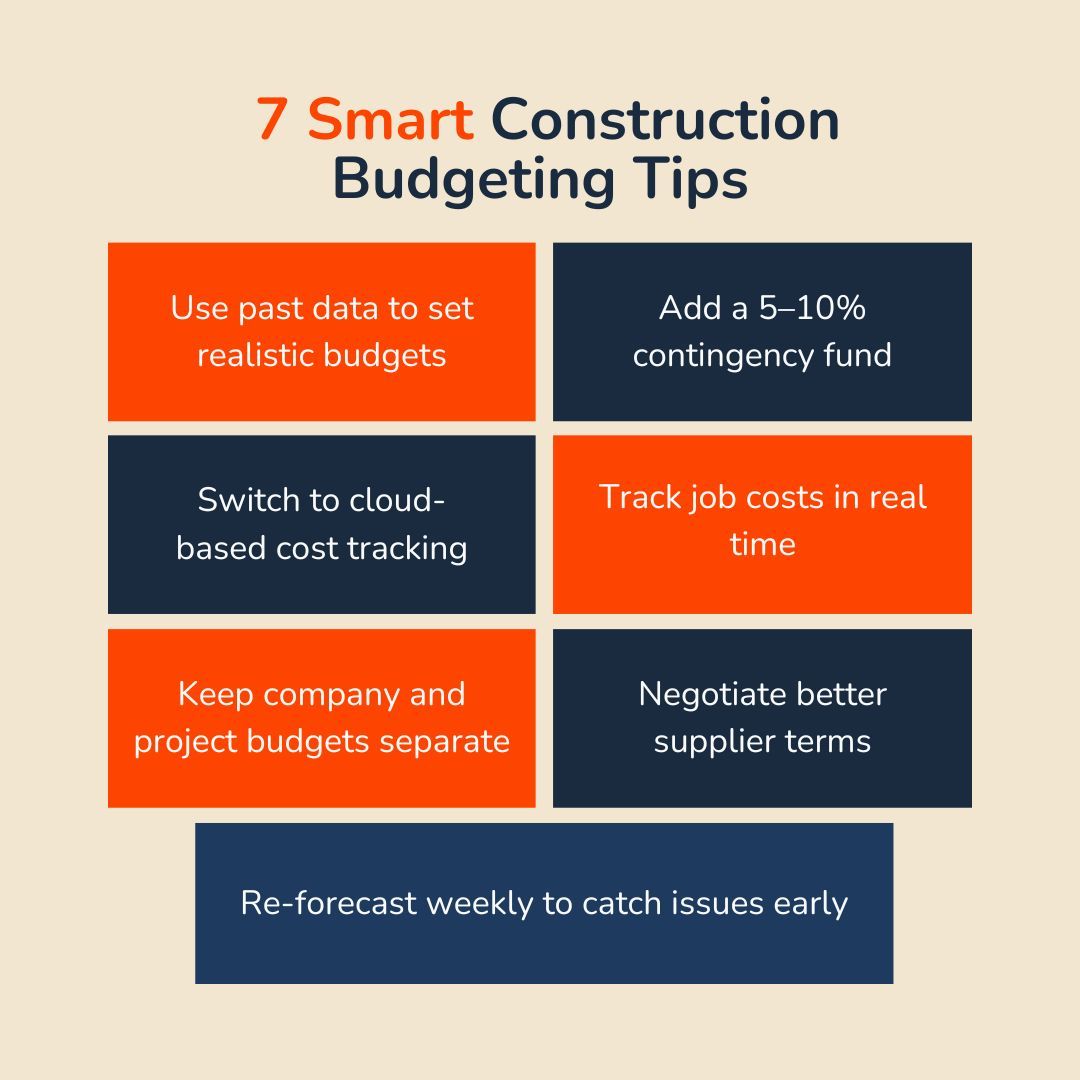

7 Construction Budgeting Tips Every Small Firm Should Apply

Use these construction budgeting tips and field-tested habits to keep every construction project profitable, on track, and prepared for surprises.

1. Build a Realistic Baseline Using Historical Data

The best construction budget starts with reviewing previous projects. Analyse where costs went over (or under) in similar jobs. Especially labor, material, and overhead costs.

Smart construction project managers use this data to set a realistic baseline for the current project budget, thereby accounting for all costs, both direct and indirect, from the outset.

2. Add a 5–10% Contingency & Risk Allowance

Every construction project budget should include a contingency fund of at least 5–10%. This isn’t just for catastrophic failures. It’s for everyday surprises like higher permit costs, sudden labor shortages, or scope changes.

By making contingency part of your budgeting process, you can cover unforeseen costs without derailing the total budget.

3. Adopt Cloud-Based Estimating & Cost-Tracking Software

Modern construction management software automates cost estimation, tracks project costs in real-time, and alerts you to budget overruns before they spiral out of control.

Tools like Constructionbase let you update cost estimates, monitor direct costs, and quickly compare budgeted vs. actual expenses.

This data-driven approach to budget management helps construction project managers make quick, informed decisions.

Check out: The Role of Construction Estimating Software in Cost Control

4. Monitor Job Costs in Real Time, Not Just at Month-End

Waiting until the end of the month to review construction expenses is a recipe for disaster. Instead, use mobile apps and cloud platforms to update project expenses as soon as they happen.

Real-time job costing software gives project owners and project managers an up-to-the-minute snapshot of a project’s financial health.

5. Separate Project and Company Finances to Avoid Cross-Contamination

It’s tempting to borrow from one project budget to cover another’s shortfall, but this approach leads to confusion and missed costs.

Using a dedicated construction budget template for each job and keeping a separate account for project funds makes construction budget management easier and supports accurate project reporting.

6. Negotiate Bulk Material Purchases & Favorable Supplier Terms

Building a solid relationship with suppliers can help small construction firms get discounts on material costs, negotiate better payment terms, and lock in prices for future projects.

These savings directly impact the construction company’s bottom line, providing more flexibility in the overall budgeting process.

7. Review & Re-Forecast Weekly to Catch Drift Early

The construction budgeting process should be ongoing and continuous. Set aside time every week to compare cost estimates to actual expenses, re-forecast for

the remaining project phase, and adjust for any new risks.

Weekly check-ins with site leads and project managers keep the project on track and catch small issues before they become major cost overruns.

See how advanced tools can assist you here.

Construction Budget Templates & Tools That Simplify Budget Management

The right tech stack makes creating a construction budget easier, faster, and more accurate.

1. Cloud-Based Estimating & Cost-Control Platforms

According to Gartner, nearly one-third of firms using cloud-based budgeting tools avoided overruns through careful budgeting, monitoring, and resource optimization.

Platforms like Constructionbase offer end-to-end construction management software, including cost estimation, job costing, and real-time dashboards.

These systems centralize every construction project budget, making it easy for project managers and general contractors to monitor costs, approve change orders, and report to project owners.

2. Excel & Google-Sheet Job-Costing Templates

For smaller firms or those just starting to digitize, customized spreadsheets can still provide powerful insights.

A construction budget template in Excel or Google Sheets should list all direct and indirect costs, labor, overhead, contingency, and a comparison of projected versus actual expenses.

However, manual spreadsheets can be prone to errors and lack real-time updates.

3. Mobile Apps for Capturing Site Expenses

Apps of your construction management software enable crews and project managers to snap receipts, record fuel usage, and track delivery charges directly from the job site.

The immediate entry of actual expenses helps prevent forgotten costs and ensures an accurate construction project budget.

Also see: How Much Money Are You Losing Without Construction Management Tools?

Communicating Budget Status to Clients & Crews

Transparent budget communication builds trust and reduces end-of-project disputes.

1. Clear, Visual Budget Dashboards

Sharing a simple dashboard with clients and site leads keeps everyone informed about project progress, scope, and budget health. Visuals highlight where project costs are tracking as planned and where adjustments are needed.

2. Formal Change-Order Protocols

Whenever the project scope changes, whether due to client requests or unforeseen costs, log a formal change order. This ensures project owners understand the impact on the construction budget and protects both parties from future disagreements.

3. Weekly Budget Stand-Ups with Site Leads

Schedule a brief check-in each week to review project expenses, address issues, and update the budget forecast. Involving project managers and field leads in the budget management process helps spot problems early and builds a culture of accountability.

Explore: Improving Client Connections through Construction CRM.

Common Budgeting Mistakes to Avoid

Avoid these costly errors to keep every construction project on budget:

- Under-estimating contingency: Without a proper contingency fund, even small, unexpected costs can lead to budget overruns and cash flow problems.

- Mixing personal and project funds: Blurring these lines makes it nearly impossible to track actual expenses and project finances accurately.

- Ignoring small-ticket expenses: Office supplies, fuel, and daily consumables add up. Track all the costs to avoid cost overruns.

- Delaying cost-to-complete reviews: Waiting until the end of the project phase to review costs leads to missed overruns. Monitor project budget progress regularly.

Why is Constructionbase the perfect choice for small construction companies?

Constructionbase is a construction management solution built for construction businesses of all sizes.

It streamlines every aspect of construction budget management, from creating a construction budget and tracking direct costs to managing change orders, project scope, and cash flow.

Here's how

- Accurate Cost Projections: Utilizes real-time market data and historical analytics for accurate forecasting.

- Seamless Expense Integration: Automatically integrates supplier quotes and current rates for strong financial forecasting.

- Rapid Scenario Analysis: Simulates design updates and market trends for rapid budget adjustments.

- Streamlined Budgeting & Planning: Automates calculations and ensures compliance to cost controls.

Additionally, with robust reporting, dashboards, and mobile tools for field updates, Constructionbase helps construction firms control project expenses and deliver successful project delivery every time.

In a nutshell

Small construction businesses face intense pressure to control project costs and avoid budget overruns.

Managing a small construction business is challenging, but with good budgeting habits, it gets easier. Monitoring labor costs, using reliable estimators, and tracking expenses helps ensure better profits and fewer surprises.

Effective budgeting is not just about calculations but about making more confident decisions. When your construction estimates are accurate, your bids become more competitive, clients have greater trust in you, and your business has the potential to grow more profitably.

Ready to Tighten Your Budgets?

Start small. Stay consistent with Constructionbase. And watch how big of a difference your budget can make.

FAQs

1. How often should I review my construction budget?

You should review your construction project budget weekly, if not daily. Regular check-ins let you compare cost estimates to actual expenses, catch cost overruns early, and make quick adjustments.

2. What contingency percentage is realistic for small projects?

A 5–10% contingency fund is recommended for most small construction projects. This covers unexpected costs, scope changes, and indirect costs that can arise during the construction phase.

3. Which software integrates estimating and real-time cost tracking?

Platforms like Constructionbase offer integrated estimating, real-time job costing software, and project management tools, making it easier to manage all the costs involved.

4. How do I handle scope creep without blowing the budget?

Always log scope changes with a formal change order and update your construction budget template accordingly. Open communication with project owners and regular reviews prevent surprise overruns.

5. What financial metrics should I track on a weekly basis?

Monitor project costs, contingency fund balance, actual vs. budgeted expenses, cash flow, and project progress to keep your project’s financial health on track.

Have questions or need personalized advice?

Talk to an Expert Today and let our construction specialists guide you to success.