Audio overview: Listen & Learn

Ever had to pause a project because the money didn’t add up? You’re not alone.

For many construction company owners and financial managers, managing construction cash flow can feel like a moving target, one that could halt operations overnight if not managed properly.

In the construction world, where payment delays, surprise costs, and overlapping projects are the norm, having a steady cash flow isn’t just nice to have; it’s your project's lifeline.

Cash flow involves the movement of money going in and out of your business, and in construction, it's often the most challenging aspect! Let's identify common pitfalls, actionable strategies, tools to simplify the process, and signs to watch for.

How to Effectively Manage a Construction Cash Flow Management System?

Cash flow isn’t just a spreadsheet figure. It’s what keeps materials on-site, labor paid, and progress steady. Construction companies face unique cash flow challenges, including clients delaying payments, unexpected fluctuations in material prices, and the need to manage multiple projects simultaneously.

In this article, you’ll find practical tips, forecasting advice, and tech tools that help construction businesses stay financially healthy and walk you through how to manage cash flow in construction projects, the real-world way.

Key Takeaways:

- Construction companies face distinct cash flow challenges, including clients postponing payments, sudden changes in material costs, and the need to manage multiple projects simultaneously.

- When cash flow drops, it can cause payroll delays, halted material orders, and unhappy clients. With planning and support, you can manage these issues and maintain progress.

- Construction companies should set realistic payment milestones, track expenses, use accounting software, maintain financial stability, and review cash flow often.

- Constructionbase software tackles construction companies' cash flow issues better than spreadsheets by offering tools aligned with contractors' workflows.

Why Cash Flow in Construction Is So Different From Other Industries

Unlike retail or services, construction operates on a project-based billing model. That means you might spend thousands on labor and materials before seeing a dime from the client. Key cash flow types include:

- Operating cash flow: Day-to-day income and expenses.

- Financing cash flow: Loans and repayments.

- Investing cash flow: Equipment purchases or long-term investments.

You often pay workers weekly but bill clients monthly or after milestones, creating natural cash gaps.

Statistical Highlight:

According to a 2024 Construction Dive report, 43% of subcontractors don’t have enough working capital to cover unexpected costs or project delays, and 29% say overdue invoices slow down project progress. (source)

What Happens When Cash Flow Slips? (And How to Spot It Early)

When cash flow dips, it can really shake things up, such as payroll delays, halted material orders, and frustrated clients. But with a bit of planning and support, you can navigate these challenges smoothly and keep everything moving forward.

Here are common causes:

- Delayed client payments

- Inaccurate cost forecasting

- Seasonal work slowdowns

Quick Checklist: Signs your cash flow might be in trouble:

- You're relying on credit cards to cover payroll.

- Project costs are rising faster than receivables.

- You’ve had to delay vendor payments.

Common cash flow problems in construction:

Let’s explore some common challenges you might encounter:

- Delayed receivables

- Overestimated profits

- Labor overages

- Poor visibility across multiple projects

How to Solve Them Fast: Introducing Cash Flow Projection

A cash flow projection report helps you get a clear picture of your finances by estimating your future income and expenses.

- Future income (client payments, loans)

- Upcoming expenses (materials, payroll, equipment)

Your cash reserves accumulate and grow over time.

How to Do It:

- List all expected cash inflows by week or month.

- Add up all cash outflows for the same period.

- Subtract outflows from inflows to see your cash position.

- Identify low-cash periods early and adjust before they hit.

Why it matters: It keeps your construction project financially viable, prevents surprises, and gives you time to act, not react.

Also Explore: The Importance of Construction Estimating Software in Cost Management

The Cash Flow Statement: Your Financial Mirror

Your cash flow statement is one of the most important financial tools in your construction business. It gives a real-time snapshot of cash inflows and cash outflows, helping you answer the big question:

“Do I have enough money to keep this project and my company moving?”

1. What It Shows:

- Cash Inflows – Client payments, loans, and equipment or asset sales

- Cash Outflows – Payroll, equipment rentals, materials, subcontractors, insurance

2. Construction-Specific Cash Flow Factors:

- Retainage – Earned but withheld money. If not accounted for, it can strain cash flow.

- Project-Based Payroll – Specialized labor costs vary significantly across different job types.

- Material Pre-orders – You often pay upfront, long before installation.

- Equipment Rentals – Regular operating expenses that affect your available cash.

These elements are often what most affect cash flow and what makes construction different from other industries.

3. Why It Matters:

- Positive cash flow means you’re earning more than you’re spending.

- Negative cash flow means your expenses are outpacing your income, a risky sign.

Without regular review, you may not spot upcoming future cash needs, leading to payment delays or halted progress.

A strong cash flow statement keeps your projects on track, covers unexpected expenses, and protects your construction company’s financial health.

Constructionbase makes it easy, with real-time statements, automated tracking of retainage, and a clear view of your cash position without the spreadsheet stress.

How to Calculate Cash Flow in a Way That Actually Makes Sense

Use this simple formula:

Net Cash Flow = Total Cash Inflows - Total Cash Outflows

Example:

- Cash received: $120,000

- Cash paid out: $95,000

- Net cash flow: $25,000 (positive)

Tool Tip: Use cash flow projection or construction estimating software reports to forecast your next 30/60/90 days.

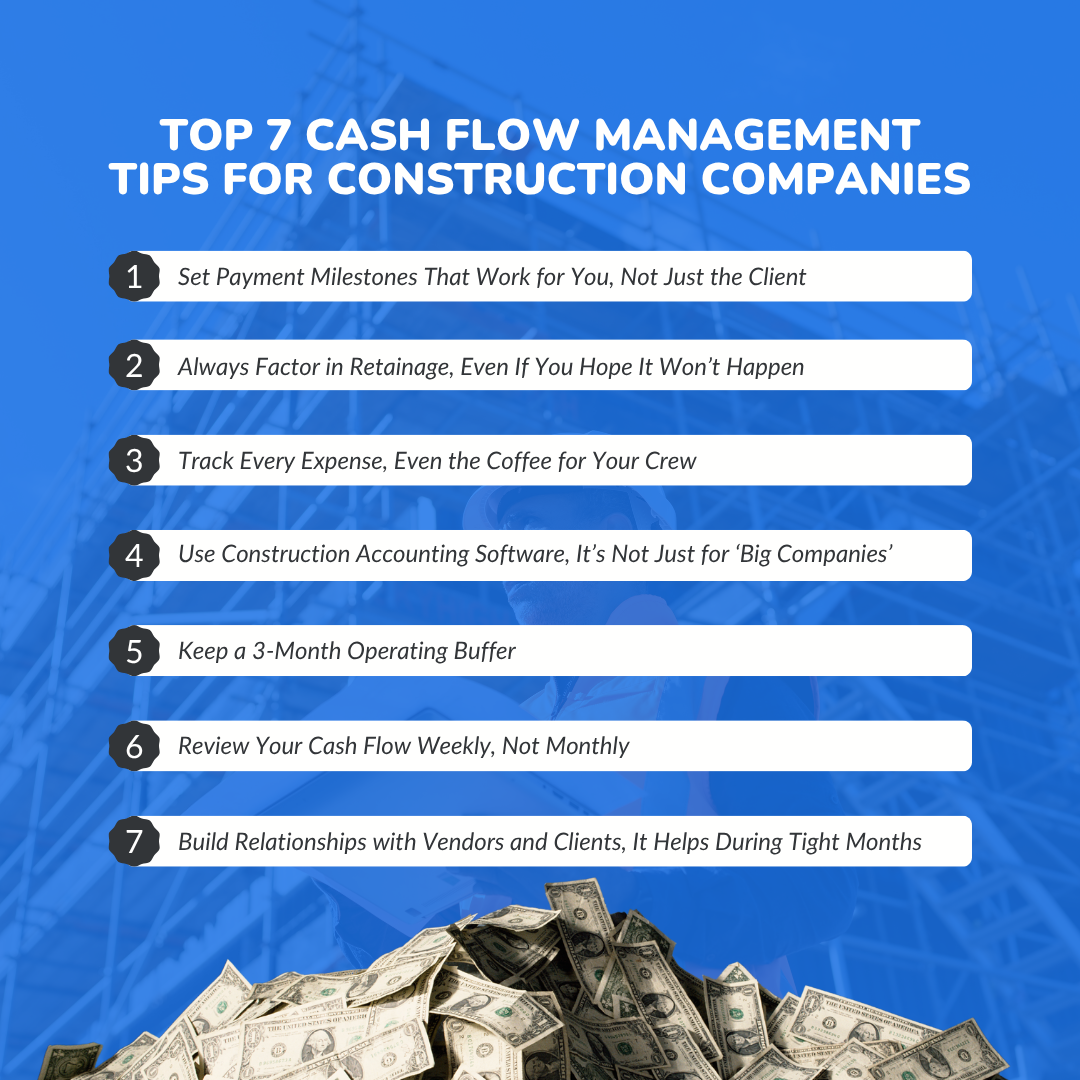

Top 7 Cash Flow Management Tips for Construction Companies

Effectively managing your construction company’s cash flow isn’t just about having more money; it’s about creating a financial system that protects your profit margins, absorbs unexpected expenses, and supports your project management process.

These seven strategies can help ensure your construction business remains financially viable through every stage of a project.

1. Set Payment Milestones That Work for You, Not Just the Client

One of the biggest reasons construction companies experience negative cash flow is misaligned payment terms.

Too often, large lump sum payments are scheduled after project completion, leaving contractors to absorb the costs upfront.

- Actionable Tip: Break your contract into realistic payment milestones, such as design approval, site preparation, the halfway mark, and final delivery. Request an upfront deposit to initiate the project and structure payments to align with your operating expenses.

- Why it works: This strategy improves cash inflows and strengthens your cash position throughout the job.

2. Always Factor in Retainage

Retainage (withholding a portion of payment until the end) can severely impact your ability to cover expenses, especially across multiple projects.

It’s essential to include retainage as a line item in your cash flow forecast.

- Insight: Plan retainage as a “delayed income” in your financial statements, don’t count it as accessible cash until it’s released.

- Why it matters: Ignoring retainage could create negative cash flow, putting strain on your daily operations and affecting your team’s productivity.

3. Track Every Expense, Even the Coffee for Your Crew

Every dollar counts when you’re trying to improve cash flow. Small, unmanaged costs can quickly snowball and erode your profit margins.

Even fuel, office supplies, and food can impact your construction company’s financial health over time.

- Tool Tip: Utilize construction accounting software or mobile-friendly apps to track costs in real-time and link them to the specific construction project to which they belong.

- Why it helps: You build a clearer picture of your actual costs, making your cash flow analysis far more accurate.

4. Use Construction Accounting Software, It’s Built for This

Trying to manage your cash flow statement manually or in Excel increases the risk of missing vital data, especially when working on multiple construction projects at once.

- Best Practice: Utilize software like Constructionbase, which enables you to generate a cash flow projection report, track receivables, and automate alerts when your financial data indicates potential risks.

- Why it’s crucial: Software streamlines financial planning, reduces human error, and offers 24/7 visibility into your cash flow generated vs. expected.

5. Keep a 3-Month Operating Buffer, Just in Case

Many cash flow challenges arise when companies encounter unexpected expenses without a buffer, such as weather delays, machinery repairs, and material price spikes.

Having a cushion helps you maintain financial stability during unpredictable cycles.

- Rule of Thumb: Save enough to cover operating expenses for 3 months. This includes payroll, rent, insurance, and ongoing project costs.

- Why it secures your business: It ensures your project remains financially viable, even when payments are delayed or project scopes shift.

6. Review Cash Flow Weekly, Not Monthly

Cash flow issues can escalate quickly. Waiting until the end of the month to assess your company’s cash flow is often too late.

- Smart Habit: Set up a simple weekly cash review every Friday. Look at inflows, outflows, upcoming billing, and pending payments. Flag any gaps promptly and adjust your actions accordingly.

- Quote-worthy tip: “If you manage your cash flow forecast like your project schedule, you’ll never be caught off guard.”

- Why it works: You’ll have enough time to reallocate funds, speak with clients, or pause discretionary spending.

7. Build Strong Vendor and Client Relationships

Strong relationships are the secret weapon for long-term cash flow management. Vendors who trust you may offer flexible payment terms. Clients who respect you are less likely to delay payments.

- Communication Tip: Set clear expectations upfront, about payment schedules, penalties for late payments, and timelines. Don’t wait until a crisis to start that conversation.

- Why it pays off: During tight periods, those strong ties can help you cover unexpected expenses, reduce pressure on your cash reserves, and protect your reputation.

> How Technology Can Take the Load Off?

Good software doesn’t just save time, it prevents mistakes. Construction accounting software helps with:

- Real-time expense tracking

- Integration with invoicing systems

- Alerts for cash flow shortages

Here's how to choose the best construction management software to boost your company's cash flow and lighten the load.

When to Call In Help: Do You Need a Financial Manager or Software Upgrade?

Even the most experienced contractors reach a point where managing cash flow with basic tools no longer suffices.

If your construction company’s cash flow feels unpredictable or you're constantly chasing payments, it might be time to upgrade your system or bring in professional support.

Poor cash flow management affects more than just your finances; it can strain your operations and lead to project delays. Spotting these issues early can prevent major problems later, such as insufficient funds to pay your crew or purchase materials when they're most needed.

Here's how you can check for that:

Checklist: Signs It’s Time for Outside Help

Ask yourself honestly, do any of these apply?

- You’re still using spreadsheets to track payments, invoices, and cash inflows/outflows.

- You’re handling multiple projects, and managing cash flow across them is getting cluttered.

- Your billing cycles are inconsistent, and clients often delay payments.

- You're unsure what your cash flow statement shows until it’s too late.

- You're not forecasting your future cash needs or planning for future cash inflows.

- Your financial statements don’t reflect what’s actually happening on the ground.

If you said “Yes” to even one, it’s time to act!

Here’s how to take back control and make your cash flow management more effective:

> Upgrade to Software Designed for Contractors

Spreadsheets were great when your company had one or two projects. But once you grow, they create more cash flow challenges than they solve.

A modern construction accounting software offers:

- Automatic syncing of invoices and expenses

- Real-time contractor’s cash flow insights

- Smart dashboards that show cash flow generated per project

- Easy tracking of operating expenses and future cash inflows

- Alerts when your cash position drops below safe levels

Explore: Benefits of Integrating Construction Software into Your Business Operations

Bonus: You’ll gain a clearer picture of what positive cash flow means in real terms, not just profit on paper, but cash in your account when you need it.

> Consult a Financial Manager Who Understands Construction

If you feel stuck interpreting your cash flow statement or don’t have time to create cash flow forecasts, a construction-savvy financial advisor can help. They’ll provide:

- Cash flow analysis tailored to specific construction projects

- Help with budgeting for unexpected expenses

- Advice on keeping your project financially viable

- Strategies to boost financial stability over the long run

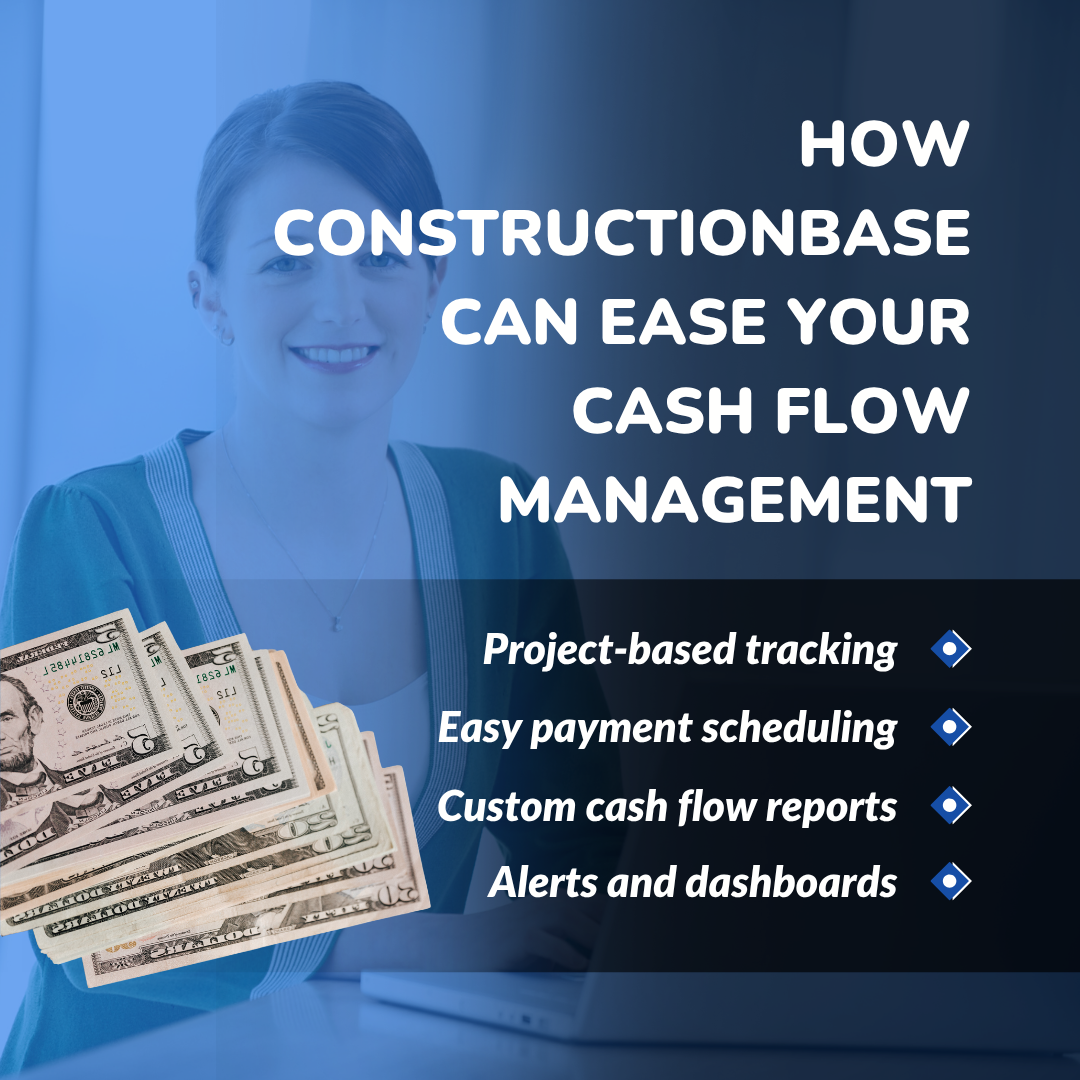

How Constructionbase Can Ease Your Cash Flow Management

Constructionbase is built to solve the real-world cash flow challenges faced by construction companies. It goes beyond spreadsheets by offering tools that align with how contractors actually work.

Key Features:

- Project-Based Tracking:

Monitor income and expenses per job, so you always know the financial health of each project. - Flexible Payment Scheduling:

Set custom billing milestones, automate invoices, and align cash inflows with your work progress. - Cash Flow Projection Reports:

Generate clear, real-time reports to forecast future cash needs and spot shortfalls early. - Alerts and Dashboards:

Get notified of potential cash gaps, delayed payments, or budget overruns, all in one visual dashboard.

With Constructionbase, you don’t just track your company’s cash flow; you manage it smarter, faster, and with confidence.

Final Thoughts: Keeping the Heart of Your Business Beating

You don’t have to be a financial expert. You need consistent, clear practices. Cash flow isn’t only about numbers; it’s about protecting your people, your deadlines, and your company’s future.

Knowing when to ask for help is part of building a resilient business. Whether you choose to adopt better software or partner with an expert, the goal is to ensure your projects move forward without the constant fear of running out of cash.

Because at the end of the day, effective cash flow management isn’t about spreadsheets, it’s about being able to finish what you started, pay your people on time, and build your company’s legacy with confidence.

About Constructionbase

Constructionbase is a smart, intuitive SaaS solution built specifically for the construction industry.

From cash flow monitoring to real-time project financials, we make staying on top of your finances simple. Explore today!

FAQs

1. What is positive cash flow?

When your cash inflows are higher than your outflows, it means you're bringing in more money than you're spending. That's great for your financial health!

2. What does negative cash flow mean in construction?

Negative cash flow often happens due to late payments, poor forecasting, contracts that are priced too low, and projects that get delayed. Recognizing these issues early can help you find ways to improve your financial health and keep your projects on track.

3. Can software really help with cash flow?

Using dedicated construction accounting software can help you avoid mistakes, make invoicing faster, and keep an eye on your financial health in real-time. It's a great way to stay organized and efficient.

Have questions or need personalized advice?

Talk to an Expert Today and let our construction specialists guide you to success.